Note

Access to this page requires authorization. You can try signing in or changing directories.

Access to this page requires authorization. You can try changing directories.

The combination of SQL language and JavaScript user-defined functions (UDFs) and user-defined aggregates (UDAs) in Azure Stream Analytics enables users to perform advanced analytics. Advanced analytics might include online machine learning training and scoring, and stateful process simulation. This article describes how to perform linear regression in an Azure Stream Analytics job that does continuous training and scoring in a high-frequency trading scenario.

High-frequency trading

The logical flow of high-frequency trading is about:

- Getting real-time quotes from a security exchange.

- Building a predictive model around the quotes, so we can anticipate the price movement.

- Placing buy or sell orders to make money from the successful prediction of the price movements.

As a result, we need:

- A real-time quote feed.

- A predictive model that can operate on the real-time quotes.

- A trading simulation that demonstrates the profit or loss of the trading algorithm.

Real-time quote feed

Investors Exchange (IEX) offers free real-time bid and ask quotes by using socket.io. A simple console program can be written to receive real-time quotes and push to Azure Event Hubs as a data source. The following code is a skeleton of the program. The code omits error handling for brevity. You also need to include SocketIoClientDotNet and WindowsAzure.ServiceBus NuGet packages in your project.

using Quobject.SocketIoClientDotNet.Client;

using Microsoft.ServiceBus.Messaging;

var symbols = "msft,fb,amzn,goog";

var eventHubClient = EventHubClient.CreateFromConnectionString(connectionString, eventHubName);

var socket = IO.Socket("https://ws-api.iextrading.com/1.0/tops");

socket.On(Socket.EVENT_MESSAGE, (message) =>

{

eventHubClient.Send(new EventData(Encoding.UTF8.GetBytes((string)message)));

});

socket.On(Socket.EVENT_CONNECT, () =>

{

socket.Emit("subscribe", symbols);

});

Here are some generated sample events:

{"symbol":"MSFT","marketPercent":0.03246,"bidSize":100,"bidPrice":74.8,"askSize":300,"askPrice":74.83,volume":70572,"lastSalePrice":74.825,"lastSaleSize":100,"lastSaleTime":1506953355123,lastUpdated":1506953357170,"sector":"softwareservices","securityType":"commonstock"}

{"symbol":"GOOG","marketPercent":0.04825,"bidSize":114,"bidPrice":870,"askSize":0,"askPrice":0,volume":11240,"lastSalePrice":959.47,"lastSaleSize":60,"lastSaleTime":1506953317571,lastUpdated":1506953357633,"sector":"softwareservices","securityType":"commonstock"}

{"symbol":"MSFT","marketPercent":0.03244,"bidSize":100,"bidPrice":74.8,"askSize":100,"askPrice":74.83,volume":70572,"lastSalePrice":74.825,"lastSaleSize":100,"lastSaleTime":1506953355123,lastUpdated":1506953359118,"sector":"softwareservices","securityType":"commonstock"}

{"symbol":"FB","marketPercent":0.01211,"bidSize":100,"bidPrice":169.9,"askSize":100,"askPrice":170.67,volume":39042,"lastSalePrice":170.67,"lastSaleSize":100,"lastSaleTime":1506953351912,lastUpdated":1506953359641,"sector":"softwareservices","securityType":"commonstock"}

{"symbol":"GOOG","marketPercent":0.04795,"bidSize":100,"bidPrice":959.19,"askSize":0,"askPrice":0,volume":11240,"lastSalePrice":959.47,"lastSaleSize":60,"lastSaleTime":1506953317571,lastUpdated":1506953360949,"sector":"softwareservices","securityType":"commonstock"}

{"symbol":"FB","marketPercent":0.0121,"bidSize":100,"bidPrice":169.9,"askSize":100,"askPrice":170.7,volume":39042,"lastSalePrice":170.67,"lastSaleSize":100,"lastSaleTime":1506953351912,lastUpdated":1506953362205,"sector":"softwareservices","securityType":"commonstock"}

{"symbol":"GOOG","marketPercent":0.04795,"bidSize":114,"bidPrice":870,"askSize":0,"askPrice":0,volume":11240,"lastSalePrice":959.47,"lastSaleSize":60,"lastSaleTime":1506953317571,lastUpdated":1506953362629,"sector":"softwareservices","securityType":"commonstock"}

Note

The time stamp of the event is lastUpdated, in epoch time.

Predictive model for high-frequency trading

For this demonstration, we use a linear model described in this paper.

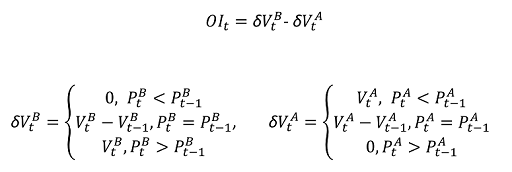

Volume order imbalance (VOI) is a function of current bid/ask price and volume, and bid/ask price and volume from the last tick. The paper identifies the correlation between VOI and future price movement. It builds a linear model between the past five VOI values and the price change in the next 10 ticks. The model is trained by using previous day's data with linear regression.

The trained model is then used to make price change predictions on quotes in the current trading day in real time. When a large enough price change is predicted, a trade is executed. Depending on the threshold setting, thousands of trades can be expected for a single stock during a trading day.

Now, let's express the training and prediction operations in an Azure Stream Analytics job.

First, the inputs are cleaned up. Epoch time is converted to datetime via DATEADD. TRY_CAST is used to coerce data types without failing the query. It's always a good practice to cast input fields to the expected data types, so there's no unexpected behavior in manipulation or comparison of the fields.

WITH

typeconvertedquotes AS (

/* convert all input fields to proper types */

SELECT

System.Timestamp AS lastUpdated,

symbol,

DATEADD(millisecond, CAST(lastSaleTime as bigint), '1970-01-01T00:00:00Z') AS lastSaleTime,

TRY_CAST(bidSize as bigint) AS bidSize,

TRY_CAST(bidPrice as float) AS bidPrice,

TRY_CAST(askSize as bigint) AS askSize,

TRY_CAST(askPrice as float) AS askPrice,

TRY_CAST(volume as bigint) AS volume,

TRY_CAST(lastSaleSize as bigint) AS lastSaleSize,

TRY_CAST(lastSalePrice as float) AS lastSalePrice

FROM quotes TIMESTAMP BY DATEADD(millisecond, CAST(lastUpdated as bigint), '1970-01-01T00:00:00Z')

),

timefilteredquotes AS (

/* filter between 7am and 1pm PST, 14:00 to 20:00 UTC */

/* clean up invalid data points */

SELECT * FROM typeconvertedquotes

WHERE DATEPART(hour, lastUpdated) >= 14 AND DATEPART(hour, lastUpdated) < 20 AND bidSize > 0 AND askSize > 0 AND bidPrice > 0 AND askPrice > 0

),

Next, we use the LAG function to get values from the last tick. One hour of LIMIT DURATION value is arbitrarily chosen. Given the quote frequency, it's safe to assume that you can find the previous tick by looking back one hour.

shiftedquotes AS (

/* get previous bid/ask price and size in order to calculate VOI */

SELECT

symbol,

(bidPrice + askPrice)/2 AS midPrice,

bidPrice,

bidSize,

askPrice,

askSize,

LAG(bidPrice) OVER (PARTITION BY symbol LIMIT DURATION(hour, 1)) AS bidPricePrev,

LAG(bidSize) OVER (PARTITION BY symbol LIMIT DURATION(hour, 1)) AS bidSizePrev,

LAG(askPrice) OVER (PARTITION BY symbol LIMIT DURATION(hour, 1)) AS askPricePrev,

LAG(askSize) OVER (PARTITION BY symbol LIMIT DURATION(hour, 1)) AS askSizePrev

FROM timefilteredquotes

),

We can then compute VOI value. We filter out the null values if the previous tick doesn't exist, just in case.

currentPriceAndVOI AS (

/* calculate VOI */

SELECT

symbol,

midPrice,

(CASE WHEN (bidPrice < bidPricePrev) THEN 0

ELSE (CASE WHEN (bidPrice = bidPricePrev) THEN (bidSize - bidSizePrev) ELSE bidSize END)

END) -

(CASE WHEN (askPrice < askPricePrev) THEN askSize

ELSE (CASE WHEN (askPrice = askPricePrev) THEN (askSize - askSizePrev) ELSE 0 END)

END) AS VOI

FROM shiftedquotes

WHERE

bidPrice IS NOT NULL AND

bidSize IS NOT NULL AND

askPrice IS NOT NULL AND

askSize IS NOT NULL AND

bidPricePrev IS NOT NULL AND

bidSizePrev IS NOT NULL AND

askPricePrev IS NOT NULL AND

askSizePrev IS NOT NULL

),

Now, we use LAG again to create a sequence with 2 consecutive VOI values, followed by 10 consecutive mid-price values.

shiftedPriceAndShiftedVOI AS (

/* get 10 future prices and 2 previous VOIs */

SELECT

symbol,

midPrice AS midPrice10,

LAG(midPrice, 1) OVER (PARTITION BY symbol LIMIT DURATION(hour, 1)) AS midPrice9,

LAG(midPrice, 2) OVER (PARTITION BY symbol LIMIT DURATION(hour, 1)) AS midPrice8,

LAG(midPrice, 3) OVER (PARTITION BY symbol LIMIT DURATION(hour, 1)) AS midPrice7,

LAG(midPrice, 4) OVER (PARTITION BY symbol LIMIT DURATION(hour, 1)) AS midPrice6,

LAG(midPrice, 5) OVER (PARTITION BY symbol LIMIT DURATION(hour, 1)) AS midPrice5,

LAG(midPrice, 6) OVER (PARTITION BY symbol LIMIT DURATION(hour, 1)) AS midPrice4,

LAG(midPrice, 7) OVER (PARTITION BY symbol LIMIT DURATION(hour, 1)) AS midPrice3,

LAG(midPrice, 8) OVER (PARTITION BY symbol LIMIT DURATION(hour, 1)) AS midPrice2,

LAG(midPrice, 9) OVER (PARTITION BY symbol LIMIT DURATION(hour, 1)) AS midPrice1,

LAG(midPrice, 10) OVER (PARTITION BY symbol LIMIT DURATION(hour, 1)) AS midPrice,

LAG(VOI, 10) OVER (PARTITION BY symbol LIMIT DURATION(hour, 1)) AS VOI1,

LAG(VOI, 11) OVER (PARTITION BY symbol LIMIT DURATION(hour, 1)) AS VOI2

FROM currentPriceAndVOI

),

We then reshape the data into inputs for a two-variable linear model. Again, we filter out the events where we don't have all the data.

modelInput AS (

/* create feature vector, x being VOI, y being delta price */

SELECT

symbol,

(midPrice1 + midPrice2 + midPrice3 + midPrice4 + midPrice5 + midPrice6 + midPrice7 + midPrice8 + midPrice9 + midPrice10)/10.0 - midPrice AS y,

VOI1 AS x1,

VOI2 AS x2

FROM shiftedPriceAndShiftedVOI

WHERE

midPrice1 IS NOT NULL AND

midPrice2 IS NOT NULL AND

midPrice3 IS NOT NULL AND

midPrice4 IS NOT NULL AND

midPrice5 IS NOT NULL AND

midPrice6 IS NOT NULL AND

midPrice7 IS NOT NULL AND

midPrice8 IS NOT NULL AND

midPrice9 IS NOT NULL AND

midPrice10 IS NOT NULL AND

midPrice IS NOT NULL AND

VOI1 IS NOT NULL AND

VOI2 IS NOT NULL

),

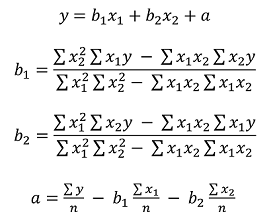

Because Azure Stream Analytics doesn't have a built-in linear regression function, we use SUM and AVG aggregates to compute the coefficients for the linear model.

modelagg AS (

/* get aggregates for linear regression calculation,

http://faculty.cas.usf.edu/mbrannick/regression/Reg2IV.html */

SELECT

symbol,

SUM(x1 * x1) AS x1x1,

SUM(x2 * x2) AS x2x2,

SUM(x1 * y) AS x1y,

SUM(x2 * y) AS x2y,

SUM(x1 * x2) AS x1x2,

AVG(y) AS avgy,

AVG(x1) AS avgx1,

AVG(x2) AS avgx2

FROM modelInput

GROUP BY symbol, TumblingWindow(hour, 24, -4)

),

modelparambs AS (

/* calculate b1 and b2 for the linear model */

SELECT

symbol,

(x2x2 * x1y - x1x2 * x2y)/(x1x1 * x2x2 - x1x2 * x1x2) AS b1,

(x1x1 * x2y - x1x2 * x1y)/(x1x1 * x2x2 - x1x2 * x1x2) AS b2,

avgy,

avgx1,

avgx2

FROM modelagg

),

model AS (

/* calculate a for the linear model */

SELECT

symbol,

avgy - b1 * avgx1 - b2 * avgx2 AS a,

b1,

b2

FROM modelparambs

),

To use the previous day's model for current event's scoring, we want to join the quotes with the model. But instead of using JOIN, we UNION the model events and quote events. Then we use LAG to pair the events with previous day's model, so we can get exactly one match. Because of the weekend, we have to look back three days. If we used a straightforward JOIN, we would get three models for every quote event.

shiftedVOI AS (

/* get two consecutive VOIs */

SELECT

symbol,

midPrice,

VOI AS VOI1,

LAG(VOI, 1) OVER (PARTITION BY symbol LIMIT DURATION(hour, 1)) AS VOI2

FROM currentPriceAndVOI

),

VOIAndModel AS (

/* combine VOIs and models */

SELECT

'voi' AS type,

symbol,

midPrice,

VOI1,

VOI2,

0.0 AS a,

0.0 AS b1,

0.0 AS b2

FROM shiftedVOI

UNION

SELECT

'model' AS type,

symbol,

0.0 AS midPrice,

0 AS VOI1,

0 AS VOI2,

a,

b1,

b2

FROM model

),

VOIANDModelJoined AS (

/* match VOIs with the latest model within 3 days (72 hours, to take the weekend into account) */

SELECT

symbol,

midPrice,

VOI1 as x1,

VOI2 as x2,

LAG(a, 1) OVER (PARTITION BY symbol LIMIT DURATION(hour, 72) WHEN type = 'model') AS a,

LAG(b1, 1) OVER (PARTITION BY symbol LIMIT DURATION(hour, 72) WHEN type = 'model') AS b1,

LAG(b2, 1) OVER (PARTITION BY symbol LIMIT DURATION(hour, 72) WHEN type = 'model') AS b2

FROM VOIAndModel

WHERE type = 'voi'

),

Now, we can make predictions and generate buy/sell signals based on the model, with a 0.02 threshold value. A trade value of 10 is buy. A trade value of -10 is sell.

prediction AS (

/* make prediction if there is a model */

SELECT

symbol,

midPrice,

a + b1 * x1 + b2 * x2 AS efpc

FROM VOIANDModelJoined

WHERE

a IS NOT NULL AND

b1 IS NOT NULL AND

b2 IS NOT NULL AND

x1 IS NOT NULL AND

x2 IS NOT NULL

),

tradeSignal AS (

/* generate buy/sell signals */

SELECT

DateAdd(hour, -7, System.Timestamp) AS time,

symbol,

midPrice,

efpc,

CASE WHEN (efpc > 0.02) THEN 10 ELSE (CASE WHEN (efpc < -0.02) THEN -10 ELSE 0 END) END AS trade,

DATETIMEFROMPARTS(DATEPART(year, System.Timestamp), DATEPART(month, System.Timestamp), DATEPART(day, System.Timestamp), 0, 0, 0, 0) as date

FROM prediction

),

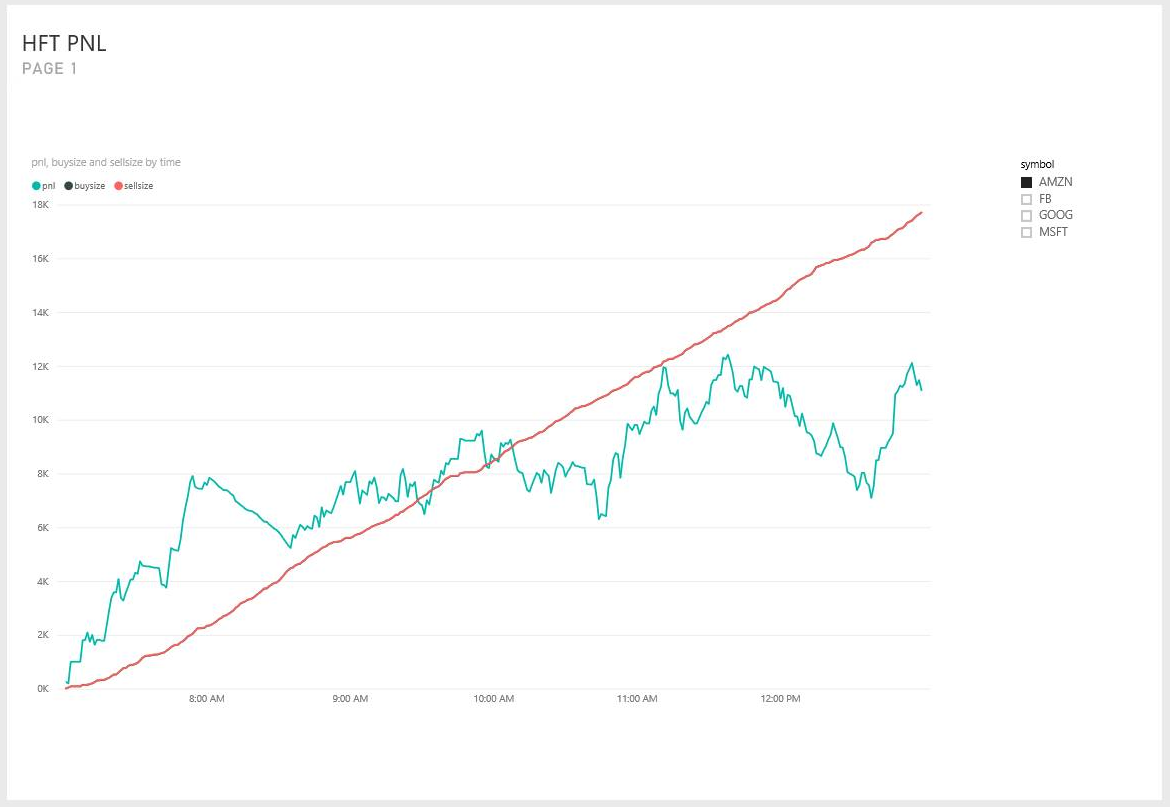

Trading simulation

After we have the trading signals, we want to test how effective the trading strategy is, without trading for real.

We achieve this test by using a UDA, with a hopping window, hopping every one minute. The grouping on date and the having clause allow the window only accounts for events that belong to the same day. For a hopping window across two days, the GROUP BY date separates the grouping into previous day and current day. The HAVING clause filters out the windows that are ending on the current day but grouping on the previous day.

simulation AS

(

/* perform trade simulation for the past 7 hours to cover an entire trading day, and generate output every minute */

SELECT

DateAdd(hour, -7, System.Timestamp) AS time,

symbol,

date,

uda.TradeSimulation(tradeSignal) AS s

FROM tradeSignal

GROUP BY HoppingWindow(minute, 420, 1), symbol, date

Having DateDiff(day, date, time) < 1 AND DATEPART(hour, time) < 13

)

The JavaScript UDA initializes all accumulators in the init function, computes the state transition with every event added to the window, and returns the simulation results at the end of the window. The general trading process is to:

- Buy stock when a buy signal is received and there's no stocking holding.

- Sell stock when a sell signal is received and there's stock holding.

- Short if there's no stock holding.

If there's a short position, and a buy signal is received, we buy to cover. We hold or short 10 shares of a stock in this simulation. The transaction cost is a flat $8.

function main() {

var TRADE_COST = 8.0;

var SHARES = 10;

this.init = function () {

this.own = false;

this.pos = 0;

this.pnl = 0.0;

this.tradeCosts = 0.0;

this.buyPrice = 0.0;

this.sellPrice = 0.0;

this.buySize = 0;

this.sellSize = 0;

this.buyTotal = 0.0;

this.sellTotal = 0.0;

}

this.accumulate = function (tradeSignal, timestamp) {

if(!this.own && tradeSignal.trade == 10) {

// Buy to open

this.own = true;

this.pos = 1;

this.buyPrice = tradeSignal.midprice;

this.tradeCosts += TRADE_COST;

this.buySize += SHARES;

this.buyTotal += SHARES * tradeSignal.midprice;

} else if(!this.own && tradeSignal.trade == -10) {

// Sell to open

this.own = true;

this.pos = -1

this.sellPrice = tradeSignal.midprice;

this.tradeCosts += TRADE_COST;

this.sellSize += SHARES;

this.sellTotal += SHARES * tradeSignal.midprice;

} else if(this.own && this.pos == 1 && tradeSignal.trade == -10) {

// Sell to close

this.own = false;

this.pos = 0;

this.sellPrice = tradeSignal.midprice;

this.tradeCosts += TRADE_COST;

this.pnl += (this.sellPrice - this.buyPrice)*SHARES - 2*TRADE_COST;

this.sellSize += SHARES;

this.sellTotal += SHARES * tradeSignal.midprice;

// Sell to open

this.own = true;

this.pos = -1;

this.sellPrice = tradeSignal.midprice;

this.tradeCosts += TRADE_COST;

this.sellSize += SHARES;

this.sellTotal += SHARES * tradeSignal.midprice;

} else if(this.own && this.pos == -1 && tradeSignal.trade == 10) {

// Buy to close

this.own = false;

this.pos = 0;

this.buyPrice = tradeSignal.midprice;

this.tradeCosts += TRADE_COST;

this.pnl += (this.sellPrice - this.buyPrice)*SHARES - 2*TRADE_COST;

this.buySize += SHARES;

this.buyTotal += SHARES * tradeSignal.midprice;

// Buy to open

this.own = true;

this.pos = 1;

this.buyPrice = tradeSignal.midprice;

this.tradeCosts += TRADE_COST;

this.buySize += SHARES;

this.buyTotal += SHARES * tradeSignal.midprice;

}

}

this.computeResult = function () {

var result = {

"pnl": this.pnl,

"buySize": this.buySize,

"sellSize": this.sellSize,

"buyTotal": this.buyTotal,

"sellTotal": this.sellTotal,

"tradeCost": this.tradeCost

};

return result;

}

}

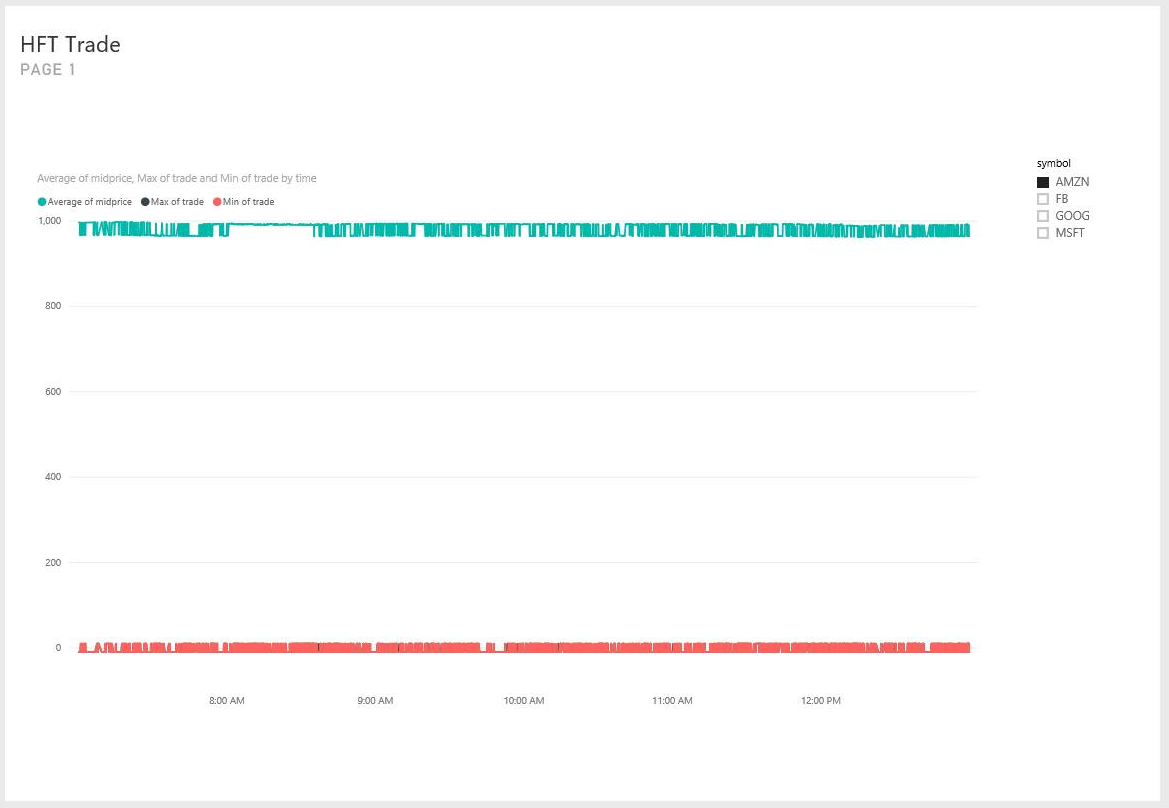

Finally, we output to the Power BI dashboard for visualization.

SELECT * INTO tradeSignalDashboard FROM tradeSignal /* output tradeSignal to PBI */

SELECT

symbol,

time,

date,

TRY_CAST(s.pnl as float) AS pnl,

TRY_CAST(s.buySize as bigint) AS buySize,

TRY_CAST(s.sellSize as bigint) AS sellSize,

TRY_CAST(s.buyTotal as float) AS buyTotal,

TRY_CAST(s.sellTotal as float) AS sellTotal

INTO pnlDashboard

FROM simulation /* output trade simulation to PBI */

Summary

We can implement a realistic high-frequency trading model with a moderately complex query in Azure Stream Analytics. We have to simplify the model from five input variables to two, because of the lack of a built-in linear regression function. But for a determined user, algorithms with higher dimensions and sophistication can possibly be implemented as JavaScript UDA as well.

Currently, the UDA can't be debugged in Visual Studio. We're working on enabling that with the ability to step through JavaScript code. In addition, the fields reaching the UDA have lowercase names. It wasn't an obvious behavior during query testing. But with Azure Stream Analytics compatibility level 1.1, we preserve the field name casing so the behavior is more natural.

I hope this article serves as an inspiration for all Azure Stream Analytics users, who can use our service to perform advanced analytics in near real time, continuously. Let us know any feedback you have to make it easier to implement queries for advanced analytics scenarios.